Introduction to Bitcoin Exchange Rates

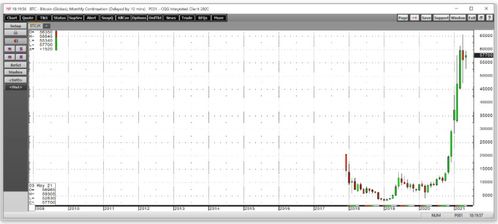

Bitcoin, the world's first decentralized digital currency, has gained significant popularity since its inception in 2009. As a cryptocurrency, Bitcoin operates independently of any central authority and is traded on various digital platforms. One of the key aspects of Bitcoin's market dynamics is its exchange rate, which fluctuates constantly due to supply and demand factors. In this article, we will delve into the concept of Bitcoin exchange rates, their importance, and how they are determined.

Understanding Bitcoin Exchange Rates

Bitcoin exchange rates refer to the value of one Bitcoin in terms of another currency, typically the US dollar (USD). These rates are constantly changing and are influenced by a variety of factors, including market sentiment, regulatory news, technological advancements, and overall economic conditions. The exchange rate is crucial for individuals and businesses looking to buy, sell, or trade Bitcoin.

Factors Influencing Bitcoin Exchange Rates

Several factors contribute to the volatility of Bitcoin exchange rates:

Market Supply and Demand: Like any other commodity, the price of Bitcoin is determined by the basic economic principle of supply and demand. If more people want to buy Bitcoin than sell it, the price will increase, and vice versa.

Market Sentiment: The perception and confidence of investors in the cryptocurrency market can significantly impact Bitcoin's price. Positive news, such as increased adoption or regulatory clarity, can lead to higher prices, while negative news can cause prices to fall.

Regulatory News: Governments and regulatory bodies around the world have varying stances on cryptocurrencies. Any news regarding regulatory changes can cause significant fluctuations in Bitcoin's exchange rate.

Technological Developments: Innovations in blockchain technology or Bitcoin's underlying protocol can influence investor confidence and, subsequently, the exchange rate.

Economic Conditions: Global economic events, such as recessions or inflation, can affect Bitcoin's exchange rate as investors seek alternative investments.

How Bitcoin Exchange Rates Are Determined

Bitcoin exchange rates are determined through a decentralized market process:

Market Makers: Large financial institutions and cryptocurrency exchanges act as market makers by providing liquidity and setting prices for Bitcoin.

Order Books: Cryptocurrency exchanges maintain order books, which list the buy and sell orders from users. The exchange rate is determined by the intersection of these orders.

Trading Volume: The volume of Bitcoin being traded on exchanges also influences the exchange rate. Higher trading volumes often indicate a more stable market.

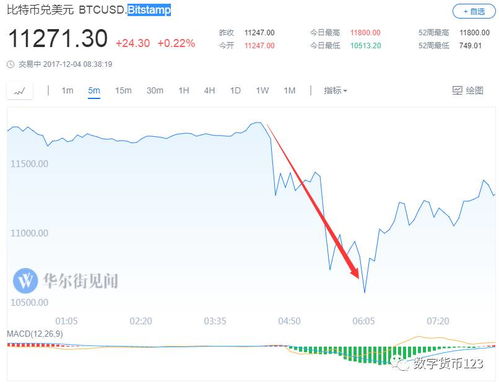

Real-Time Bitcoin Exchange Rates

Bitcoin exchange rates are available in real-time on various cryptocurrency exchanges and financial websites. These platforms provide up-to-date information on the current value of Bitcoin in different currencies. Users can track the exchange rate using charts, graphs, and other tools to make informed decisions about buying, selling, or holding Bitcoin.

Impact of Bitcoin Exchange Rates on the Economy

The fluctuations in Bitcoin exchange rates can have a ripple effect on the broader economy:

Investment Opportunities: Bitcoin offers investors a new asset class with the potential for high returns, but also high risks.

Financial Inclusion: Cryptocurrencies like Bitcoin can provide financial services to unbanked populations, as they can be accessed without traditional banking infrastructure.

Monetary Policy: Central banks may need to reconsider their monetary policy in response to the rise of cryptocurrencies, as Bitcoin can act as a store of value independent of fiat currencies.

Conclusion

Bitcoin exchange rates are a critical component of the cryptocurrency market, reflecting the dynamic nature of this emerging asset class. Understanding the factors that influence these rates can help individuals and businesses navigate the Bitcoin market more effectively. As the cryptocurrency landscape continues to evolve, keeping an eye on Bitcoin exchange rates will remain an essential part of the investment strategy for those involved in the digital currency space.